Do I Make Too Much for WA Worker Retraining? Income Limits Explained (2026)

By Irene Holden

Last Updated: January 10th 2026

Quick Explanation

Most people who were laid off, are on unemployment, exhausted benefits in the last 48 months, had a business close, or are recent veterans are treated as dislocated workers and usually face no income cap for Worker Retraining. Income mainly matters if you’re still employed and classified as a vulnerable or displaced-homemaker worker - those lanes use about 70% of Washington’s Median Family Income (roughly $44,000 for one person, about $71,000 for a family of three, and around $84,500 for a family of four) - and a separate Training Benefits test uses about 130% of the state minimum wage, which is roughly $22.27 per hour.

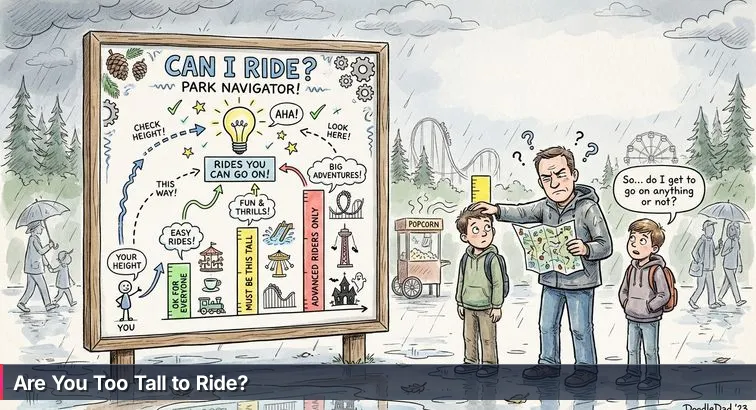

Picture yourself at the gate of a huge amusement park, staring at that “You must be this tall to ride” sign. The bars and fine print are right in front of you, but all your kid wants to know is, “So…do I get to go on anything or not?” For a lot of Washington workers trying to read through Worker Retraining rules, that’s exactly what it feels like: a wall of categories, percentages, and acronyms when you just need a straight answer about whether you still qualify for help.

You might be laid off, stuck in a temporary job, recently divorced, or watching your whole industry slow down. At the same time, phrases like “70% of Median Family Income,” “vulnerable worker,” and “Training Benefits” make it sound like there’s a secret income bar you’re supposed to fit under. The real question in your head is closer to the kid’s: “Do I get to go on anything here - or do I make too much now to get any support?” Even the State Board for Community and Technical Colleges admits, in its own overview of the Worker Retraining program, that the grant is juggling many different categories of workers at once.

The short version is that most of the main “rides” in Worker Retraining - the ones for people who were laid off, on unemployment, or whose business shut down - do not have a classic low-income cutoff. Your past wage, even if it was high, usually isn’t what keeps you from getting a wristband. Income really starts to matter in a smaller set of lanes, like when you’re still working but considered a vulnerable worker, or when you’re looking at the separate Training Benefits program that can extend unemployment. That’s where those colored lines - things like 70% of median income or 130% of minimum wage - show up as actual dollar limits.

If you do turn out to be in one of the lanes that qualifies, you can use your “ticket” at a community or technical college or at some approved private career schools. One of those options is Nucamp, an online coding bootcamp that’s been approved as a Private Career School for Washington’s program and can often combine Worker Retraining with its own scholarship so that state funds cover up to 80% of tuition and the student pays about $100/month for 5 months - $500 total out of pocket - for eligible bootcamps like web development or cybersecurity. But before you worry about where to use your funding, it helps to know whether you’re allowed through the gate at all.

“You’ll never regret spending those hours expanding your education.” - Masson, Worker Retraining participant, quoted in a Washington workforce training case study

This explainer is meant to be the park map you wish someone had handed you at the unemployment office: a clear walk-through of which lanes care about income, which don’t, and how programs like Worker Retraining and training providers like Nucamp’s Washington retraining partnership can fit together. You won’t see any promises that everyone gets a ride - but you will get enough plain-language detail to stop guessing and start having a real conversation with a workforce advisor about your situation.

What We Cover

- Do I make too much for Worker Retraining?

- Quick answer: when income matters

- What is Washington’s Worker Retraining program?

- Why income limits exist and how they’re applied

- Which eligibility lane are you in?

- How colleges verify income and document eligibility

- How Training Benefits differ from Worker Retraining

- Real examples and a quick eligibility checklist

- How Nucamp works with Worker Retraining and next steps

- Common Questions

Veterans should review the WRT for recently discharged veterans section to understand required documents.

Quick answer: when income matters

At the risk of oversimplifying, the “height chart” for Washington’s Worker Retraining program really comes down to three colored bars. In some lanes, your income isn’t measured at all; in others, it’s checked against a specific dollar limit; and in a third case, a separate unemployment program uses its own wage test. If all you want to know is “Do I make too much?” the quick answer is: it depends which lane you’re in.

Lane 1: Dislocated workers - income usually doesn’t matter

If you were laid off, are currently receiving unemployment, exhausted benefits within the last 48 months, had a business close because of the economy, or are an active-duty service member with separation orders or a recent veteran, you’re in what the state calls the dislocated worker lane. For this group, there is generally no income cap in the usual “low-income program” sense. The focus is on how you lost work and your unemployment history, not whether you used to earn $20 an hour or $60 an hour. Your past high wages can make other programs tricky, but they do not automatically knock you out of Worker Retraining.

Lane 2: Vulnerable workers - the 70% MFI bar

Income starts to matter if you’re still employed but considered at risk of unemployment - often called a vulnerable worker, or if you’re a displaced homemaker or in certain stop-gap situations. In these lanes, your household income is compared to about 70% of Washington’s Median Family Income for your family size, based on tables published by the state’s student aid agency. For example, for a family of three, 70% of median works out to roughly $71,000 a year. If your total household earnings sit under that bar and you meet the other risk factors (like being in a declining occupation or having fewer than 45 college credits), you may qualify; if you’re well above it, this is where you can feel “too tall for the ride.”

“State training dollars work best when they’re aimed at workers who are both vulnerable in today’s labor market and poised to benefit from short, focused programs.” - Education policy analysis, New America case study on Washington’s workforce system

Lane 3: Training Benefits - a separate low-wage rule

Finally, there’s a related “ride” called Training Benefits, run by the Employment Security Department, which can extend unemployment checks while you’re in approved training. This is separate from Worker Retraining money, and some categories use a different bar: you must have earned less than about 130% of the state minimum wage in your base year. With Washington’s minimum wage set at $17.13 an hour, that threshold lands around $22.27/hour. According to the agency’s overview of the programs it manages, Training Benefits are one of several tools ESD uses to help workers move into new careers while still on UI, but you can be eligible for Worker Retraining even if you’re over this Training Benefits line and never see a single extended unemployment check. You can read more on the Employment Security Department’s programs we manage page.

What is Washington’s Worker Retraining program?

Under all the policy language, Washington’s Worker Retraining program is basically the park itself: a statewide way to turn job loss or shaky employment into a ticket for specific training that leads to better work. It’s funded and coordinated through the State Board for Community and Technical Colleges, and the Workforce Training & Education Coordinating Board describes Worker Retraining as playing a major role in the state’s economic development by helping workers move into jobs local employers actually need, not just any open position. In other words, it’s designed to get you back to work in a field that can realistically support you.

Who runs it and what it’s for

The program is run day to day through Washington’s community and technical colleges, with statewide policy set in collaboration with agencies like the Workforce Training & Education Coordinating Board. In their overview of Worker Retraining’s role in the system, the board frames it as a key tool for helping the long-term unemployed and underemployed regain self-sufficiency. The core goal is simple: if your old job is gone, unstable, or no longer pays enough, Worker Retraining helps you get short, focused training in an in-demand field so you can land on your feet.

Where you can use it

Your Worker Retraining “ticket” can be used at Washington’s network of public colleges and a limited set of approved private career schools. Every participating school has to meet state licensing rules and follow the same eligibility categories. That means you might use Worker Retraining to enroll in a welding or nursing program at a local technical college, or in a coding or cybersecurity bootcamp at an approved provider like Nucamp, which is authorized as a Private Career School and can layer Worker Retraining with its own scholarship so eligible students see up to 80% of tuition covered and pay about $100/month for five months out of pocket.

What the money can cover

Exactly what’s covered can vary by college and by term, but Worker Retraining funds are primarily meant to help with tuition and mandatory fees for approved programs. When funding allows, schools may also use it to offset costs like books, tools, supplies, or even limited transportation support, and many wrap in advising so you’re not picking a program at random. The idea is to remove enough financial friction that you can realistically complete training, not just start it.

Who it’s trying to help

The program focuses on people who are unemployed or underemployed: workers laid off from full-time jobs, people stuck in “stop-gap” roles that pay far less than they used to earn, displaced homemakers who suddenly have to provide for a family, recent veterans, and others considered at risk of long-term job loss. A University of Washington continuing education piece on training after layoffs notes that state programs like Worker Retraining are specifically geared toward moving people into high-demand fields such as healthcare, IT, and advanced manufacturing, where employers are actively hiring. Worker Retraining is the mechanism that helps pay for that pivot so you’re not trying to carry the full cost of retraining on top of everything else you’re dealing with.

Why income limits exist and how they’re applied

Income limits are there because, underneath the forms and acronyms, the state is trying to answer a fairness question: with a limited pool of Worker Retraining dollars, who most urgently needs help to get back on their feet? It’s less about judging whether you “deserve” support and more about sorting people into lines when there aren’t enough seats for everyone, especially in categories where folks are still working and not yet fully out of the labor force.

Two different problems the state is solving

When you apply, the system is really asking two separate questions. First: Did something significant happen to your job? A layoff, plant closure, business failure, or military separation usually goes in this bucket. For those situations, Worker Retraining guidelines treat you as a dislocated worker, and the focus is on documentation and timing, not on whether your last job paid well. Second: If you’re still working, are you actually self-sufficient? That’s where income comes in - if you’re in a “stop-gap” job that pays about half of what you used to earn, or you’re a displaced homemaker suddenly trying to support a family, the program needs a way to tell whether you’re really on stable ground or just treading water.

Why 70% of Median Family Income shows up

For people who haven’t been laid off but are considered vulnerable workers - still employed, but in a declining field or without enough education - the state uses a standard yardstick: about 70% of Washington’s Median Family Income for your household size. Those numbers come from the Washington Student Achievement Council’s median-income tables used across state aid programs. They climb with family size; for example, 70% of median for a one-person household is roughly $44,000 a year, while for a family of four it’s around $84,500. If your current household earnings fall under the line for your family size and you meet other risk criteria, the state treats you as not yet self-sufficient and prioritizes you for help.

How “stop-gap” work fits into the picture

There’s a slightly different test for people who grabbed any job they could after a layoff. Colleges often follow guidance like that on Clover Park Technical College’s Worker Retraining page, where a new job is considered stop-gap employment if it pays about 50% or less of what you made before. That’s not a poverty test; it’s a way of saying, “You’re working, but this role clearly isn’t a long-term, living-wage replacement.” In those cases, your lower current income actually helps show that you still need retraining support rather than counting against you.

Why this feels so personal when it’s really structural

Because these lines are drawn in dollars, it can feel like a judgment on your worth or how hard you’ve worked. In reality, the income bars and wage comparisons are blunt tools the state uses to triage limited funds toward people who are both at risk in the labor market and likely to benefit from short, focused training. That’s why someone laid off from a higher-paying job may still qualify with no income cap, while someone in a modest but steady household that sits just above 70% of median might not. Understanding that logic doesn’t make the process fun, but it can at least make the ride sign readable instead of random.

Which eligibility lane are you in?

Think of eligibility like a set of clearly marked lines at the entrance: you don’t need to memorize the policy manual, you just need to know which line you belong in. Worker Retraining sorts people into a few main “lanes” based on what happened to their job and what their work situation looks like now. Once you know your lane, it becomes much easier to see whether income is part of your decision and what documentation you’ll need.

Lane 1: Dislocated workers

This is the core lane for people whose jobs were directly disrupted. You’re usually a dislocated worker if you:

- Were laid off or received an official layoff/closure notice

- Are currently receiving unemployment benefits from Washington ESD

- Recently exhausted your unemployment benefits (within about the last four years)

- Were formerly self-employed and your business closed due to economic conditions

- Have military separation orders or are a veteran within a set number of months after discharge

In this lane, there is generally no traditional low-income cap; the program is reacting to the fact that your job is gone, regardless of whether you used to earn a modest wage or a high salary. Veterans and formerly self-employed workers are usually assessed here as well. Colleges like North Seattle College describe this group simply as people who have lost their jobs or face imminent layoff in their Worker Retraining overview.

Lane 2: Stop-gap employment after a layoff

If you took a “for-now” job after being laid off, you might still be treated as a dislocated worker in stop-gap employment. The key test most colleges use is whether your new job pays about 50% or less of what you earned before the layoff. For example, if you used to make $30 an hour and now make around $14 an hour in retail or gig work, that’s a strong sign you’re in a stop-gap role rather than a true replacement job. This lane doesn’t rely on a median-income chart; it compares your old and new wages to show that you’re not yet back to a self-sustaining level.

Lane 3: Displaced homemakers and vulnerable workers

If you haven’t been formally laid off but you’re clearly at risk, you may fall into the displaced homemaker or broader vulnerable-worker lane. This often includes people who:

- Were out of the workforce or working part-time while caring for family, and lost a partner’s income

- Are still employed but in a job that’s not “in demand” locally

- Have completed fewer than 45 college credits and need new skills to stay employed

Here, income does matter. Your household earnings are checked against about 70% of Washington’s Median Family Income for your family size; if you’re under that line and meet the risk criteria, you may qualify. This is also the lane people often use to pair Worker Retraining with shorter, career-focused programs at community colleges or approved private schools (like Nucamp’s online bootcamps, which can combine state funding with their own scholarship so eligible students pay around $100/month for five months out of pocket). Knowing which of these three lanes you’re in is the first step before you start filling out forms or talking to an advisor.

| Lane | Typical Situation | Income Test? | Main Proof Needed |

|---|---|---|---|

| Dislocated worker | Laid off, business closed, on or recently off unemployment, recent veteran | No traditional low-income cap | Layoff or separation notice, unemployment records |

| Stop-gap employment | Took a lower-paying job after layoff | New wage about 50% or less of prior wage | Old and new pay stubs to compare wages |

| Displaced homemaker / vulnerable worker | Still working or re-entering work, at risk of unemployment | Household income under ~70% of state median for family size | Tax return or pay stubs, plus household size information |

How colleges verify income and document eligibility

By the time you’re digging through old pay stubs and tax files, it can feel like you’re being put on trial instead of asking for help. What colleges are really doing, though, is trying to measure you against the right “height bar” as accurately as they can. They have to prove to the state that you’re in the correct eligibility lane and, when income matters, that you’re actually under the line for your family size. The process is bureaucratic, but the core idea is straightforward: match your real situation to the category the rules were written for.

First check: what happened to your job?

Before anyone looks at your income, schools usually confirm your lane. For dislocated workers, they’re looking for proof that your job ended for economic or business reasons. That might be a layoff or closure notice, an unemployment benefits letter, documentation that your self-employed business closed due to the economy, or military separation papers like a DD-214. These documents answer the basic question: “Was there a qualifying job loss or transition?” If the answer is yes, and the timing fits (for example, you exhausted unemployment within the last 48 months), you may never hit a traditional income test at all.

When income actually gets pulled into the picture

Income verification really comes into play for lanes like vulnerable workers, displaced homemakers, and some stop-gap situations. There, colleges usually start with your most recent pay stubs or your latest tax return and then ask you to complete a short self-attestation form developed by the State Board for Community and Technical Colleges. Most schools focus on your net earned income (take-home pay), and they typically “annualize” it by projecting a typical month over 12 months to compare against the 70% Median Family Income thresholds. If your income has dropped recently - say, from full-time to part-time hours - you can usually explain that in writing so they don’t rely on an old, higher number that no longer reflects your reality.

Common documents and what they prove

It helps to know what each piece of paper is actually doing for you in the process. Colleges aren’t asking for documents at random; each one checks a specific box in the state guidelines.

| Document | What it Shows | Used For |

|---|---|---|

| Layoff or closure notice | Job ended for business/economic reasons | Dislocated worker lane |

| Unemployment benefits letter | Currently on or recently exhausted UI | Confirming timing and category |

| Recent pay stubs | Current net income and hours; wage level in new job | 70% MFI checks; 50% stop-gap wage comparisons |

| Most recent tax return | Prior-year household income and family size | Baseline for vulnerable worker or displaced homemaker lanes |

Practical tips so you don’t get stuck in paperwork

A few small steps can keep you from bouncing back and forth with the financial aid office. Bring the freshest documents you have - especially if your hours or pay just changed - and be ready to jot down a simple explanation of any big shifts, like a recent separation or move from full-time to part-time work. If you’re not sure what they need, colleges like Clark College spell out typical documentation on their Worker Retraining information pages, and every school has staff whose job is to walk you through the checklist. You’re not expected to decode the rules by yourself; your role is to bring an honest picture of your situation so they can match it to the right lane and, if income matters for you, measure it against the correct bar.

How Training Benefits differ from Worker Retraining

Worker Retraining and Training Benefits often get talked about in the same breath, which is part of why the rules feel so muddy. In reality, they’re two different “rides” run by two different parts of the state system. One mainly helps pay for school or training itself. The other can extend your unemployment checks while you’re in that training. You might qualify for both, only one, or neither, depending on your work history and wages.

Different programs, often used together

Worker Retraining is a college-based program coordinated by the State Board for Community and Technical Colleges. Its job is to help cover training costs - things like tuition and required fees at community and technical colleges and approved private career schools. By contrast, Training Benefits is a program inside Washington’s unemployment system. Its role is to help cover your living costs by allowing certain eligible workers to receive unemployment benefits longer while they attend full-time, approved training.

How Training Benefits works

Training Benefits is managed by the Employment Security Department as one of several tools it uses to support workers on unemployment. If you qualify, ESD can let you keep drawing unemployment checks while you’re in an approved program instead of requiring you to search for work right away. For some Training Benefits categories, there’s a specific low-wage test: you must have earned less than about 130% of the state minimum wage in your base year. With Washington’s minimum wage set at $17.13/hour according to the Washington Department of Labor & Industries, that bar lands at roughly $22.27/hour. If you earned more than that, you may still qualify under other Training Benefits categories, but not the low-wage ones that use this rule.

“Unexpectedly losing your job can be overwhelming, but many workers don’t realize there are state programs that let them train for an in-demand career while still receiving unemployment benefits.” - UW Professional & Continuing Education, article on retraining after layoffs

Key differences at a glance

The two programs are designed to fit together, but they answer different questions. Worker Retraining asks, “Can we help you pay for training that leads to a better job?” Training Benefits asks, “Can we keep your unemployment checks going while you’re in that training?” You can qualify for Worker Retraining even if you never get Training Benefits - for example, if your past wages were too high for the 130% minimum-wage rule. And you might be approved for Training Benefits in a college program that doesn’t use Worker Retraining funds if you’re relying on other financial aid instead.

| Program | What It Pays For | Who Runs It | Key Income/Wage Rule |

|---|---|---|---|

| Worker Retraining | Tuition and mandatory fees (sometimes books/supplies) for approved training | State Board for Community & Technical Colleges via colleges and approved private schools | No income cap for most dislocated workers; some lanes use ~70% of Median Family Income |

| Training Benefits | Extended unemployment benefits while in full-time, approved training | Employment Security Department through the unemployment system | Some categories require base-year wages under ~130% of minimum wage (~$22.27/hour) |

When you talk with a workforce advisor, it helps to treat these as two separate questions: “Do I qualify for Worker Retraining to help pay for the program I want?” and “Do I qualify for Training Benefits to keep unemployment coming while I study?” Once you have answers to both, you can decide whether you can realistically commit to a community college program or a shorter, career-focused option like an online coding or cybersecurity bootcamp that works with Worker Retraining.

Real examples and a quick eligibility checklist

Seeing real situations mapped to the rules can be a lot less stressful than staring at category names. It’s the difference between watching crowds stream past the height bar and finally spotting someone your size walk through. The examples below are simplified, but they mirror the kinds of cases colleges see every day and how staff usually sort people into lanes.

Four quick scenarios, four likely lanes

Use this as a rough guide, not a final verdict. The actual decision will always come from a college workforce or financial aid office looking at your paperwork, but the table shows how Worker Retraining rules usually treat different combinations of wages, family situations, and job loss.

| Example | Situation | Likely Lane | Income Bar? |

|---|---|---|---|

| 1. High-wage software tester laid off | Earned $120,000/year in Seattle as a tester; laid off in late 2025; currently on Washington unemployment; no new job yet. | Dislocated worker (laid off and on UI) | No traditional low-income cap; past high wage does not by itself disqualify Worker Retraining eligibility. |

| 2. Manufacturing worker in a stop-gap retail job | Used to make $30/hour at a plant that closed in 2024; now earning $14/hour in retail; has fewer than 45 college credits. | Dislocated worker in stop-gap employment | New wage is under 50% of old wage (50% of $30 is $15); that supports stop-gap status more than an MFI income test. |

| 3. Displaced homemaker after divorce | Out of the labor force for 10 years caring for two kids; now divorced; working ~20 hours/week at $20/hour (~$20,800/year); family size of 3. | Displaced homemaker / vulnerable worker | Household income is well below about $71,000 (70% of median for a family of 3), so it typically passes the 70% MFI bar. |

| 4. Still-employed professional, high household income | Graphic designer earning $65,000/year; partner earns $50,000/year; one child; total household income $115,000; wants to switch fields. | Vulnerable worker candidate, but likely over income | Household income sits above roughly $84,500 (70% of median for a family of 3-4), so they often do not qualify in the income-tested lane. |

Quick self-check: four questions to ask yourself

Instead of memorizing category names, walk through these questions in order. If you can answer “yes” at an early step, that usually points you toward your lane and tells you how much your income will matter.

- Did you lose a job or business for economic reasons? If you were laid off, had a business close, exhausted unemployment within about 48 months, or have military separation papers, you’re probably in a dislocated worker lane where there is no classic low-income cutoff.

- Did you take a big pay cut in a “for-now” job? If your new job after a layoff pays around half or less of what you used to earn, colleges often treat it as stop-gap employment, using that 50% comparison more than a median-income chart.

- Are you still employed but clearly at risk? If your field is declining locally, you have under 45 college credits, or you’re re-entering the workforce after relying on a partner’s income, you may be in a vulnerable-worker or displaced-homemaker lane where your household income is checked against 70% of state median.

- Do you also need to extend unemployment checks? If you’re already on UI and want to stay on benefits while you train full time, that’s where the separate Training Benefits program and its wage rules come in.

Once you’ve sketched out your likely lane on your own, the next step is to sanity-check it with a real person. Workforce education offices at colleges like Renton Technical College invite you to meet with staff who can walk through your documents and match you to the right category; their Worker Retraining page even explains that funding priorities can shift by term, so talking to someone matters as much as reading the rules.

“Washington’s Worker Retraining program plays a major role in the state’s economic development by helping unemployed adults train for in-demand jobs.” - Workforce Training & Education Coordinating Board, state workforce case study

If you’re feeling stuck on the sidelines while others seem to move on, remember that you don’t have to get every detail right on your own. Bring your layoff notice, unemployment info, a couple of pay stubs, and your best answers to the questions above; from there, an advisor can tell you whether you’re under the right bar for a particular ride, or whether it’s time to look at other options like federal aid or shorter, lower-cost programs that fit your budget without state retraining funds.

How Nucamp works with Worker Retraining and next steps

Once you’ve figured out which eligibility lane you’re in, the next question is what to actually do with that wristband. For tech-curious workers, Nucamp is one of the simpler paths because it’s already built to plug into Washington’s Worker Retraining system. It’s an officially approved Private Career School, which means colleges and workforce staff can treat its bootcamps the same way they treat an allied health or welding program at a community college: as a legitimate, in-demand training option your Worker Retraining funding can help pay for.

How Nucamp fits into the system

Nucamp doesn’t replace your local college’s Workforce Education office; it works alongside it. The state still decides whether you meet a qualifying category like dislocated worker, stop-gap employed, displaced homemaker, formerly self-employed, recent veteran, or vulnerable worker. What Nucamp adds is a structured, online route into areas like software development and cybersecurity that fit the “high-demand, skills-focused” box state policymakers have emphasized in recent workforce reports. Because its programs are licensed as a private career school in Washington, Worker Retraining funds can be applied there when you qualify, just as they can at a public campus.

What you can study with Nucamp

The Washington-approved Nucamp tracks are designed for people pivoting into tech, often with no previous coding background. The main options include a combined path in Web Development Fundamentals plus Full Stack & Mobile Development with job-hunting support, a Back End with SQL and Python track with its own career module, and a Cybersecurity Fundamentals path that also builds in job search skills. All of these bootcamps are fully online, blend self-paced lessons with weekly live workshops, and keep workshop groups small so you’re not lost in a giant video lecture. Independent recognition, like being named “Best Overall Cybersecurity Bootcamp” by a national business magazine and holding an average rating around 4.5 out of 5 stars on major review platforms, reinforces that they’re taken seriously by learners and employers, not just by the state.

| Nucamp Program | Primary Focus | Format | Career Support Included |

|---|---|---|---|

| Web Development Fundamentals + Full Stack & Mobile | Front-end and full-stack web development | Online, with weekly live workshops | Yes - job hunting module |

| Back End with SQL and Python | Server-side development and databases | Online, with weekly live workshops | Yes - job hunting module |

| Cybersecurity Fundamentals | Security basics and defensive skills | Online, with weekly live workshops | Yes - job hunting module |

Practical next steps if you want to use Worker Retraining at Nucamp

If you think you’re in one of the eligible lanes and tech training sounds like a fit, your next moves are less about guessing rules and more about lining up conversations and paperwork. A typical path looks like this: first, talk with a workforce or Worker Retraining advisor at a community or technical college to confirm your category and whether they can help certify your eligibility. In parallel, you can submit a short online form directly to Nucamp where you pick a bootcamp, upload your layoff notice, unemployment letter, or other proof, and sign a simple self-attestation so they can verify you meet at least one of the state’s criteria.

- Sketch your likely lane using the checklist in the previous section (laid off, stop-gap, displaced homemaker, vulnerable worker, veteran, etc.).

- Contact a local college’s workforce education or Worker Retraining office to confirm your eligibility and ask what documentation they’ll need.

- Visit Nucamp’s Washington Worker Retraining page to complete their eligibility form and choose a bootcamp track that matches your goals.

- Upload supporting documents (like UI letters or separation papers) and sign the attestation so Nucamp can align you with the right state category.

- Once approved, review the reduced tuition and schedule details, then decide whether the workload and timing are realistic alongside your family and job obligations.

From there, the focus shifts from “Do I qualify for anything?” to “Can I make this specific program work in my life?” You may also be able to layer in other aid, like the Washington College Grant or new short-term Workforce Pell options, if your income and program length fit those rules. However you piece it together, the goal is the same: trade hours spent decoding fine print for hours actually building skills, so you’re not stuck at the gate watching everyone else move on to their next career ride.

Common Questions

Do I make too much to qualify for Washington Worker Retraining?

Short answer: probably not if you’re a dislocated worker (laid off, on or recently exhausted UI, business closed, or recent veteran) - that lane generally has no traditional low-income cap. Income matters mainly for the vulnerable-worker lane (roughly 70% of Median Family Income - about $71,000 for a family of three) and for some Training Benefits rules (a low-wage test at ~130% of WA minimum wage, ≈ $22.27/hour).

I’m still employed - what income cutoff applies to the “vulnerable worker” lane?

The college will compare your household earnings to about 70% of Washington’s Median Family Income for your family size (examples: roughly $44,000 for one person, ~$71,000 for three, ~$84,500 for four). You also must meet risk criteria - like being in a declining occupation or having fewer than 45 college credits - for this lane to apply.

I was laid off and used to earn well - will my past salary disqualify me?

No - past high wages do not automatically disqualify you if you’re in the dislocated worker lane; the program focuses on how your job ended and your unemployment status. Documentation such as a layoff/separation notice or ESD unemployment records (including exhaustion within about 48 months) is what matters.

How do colleges verify income and what documents should I bring?

Colleges commonly ask for recent pay stubs, your most recent tax return, layoff/unemployment letters, and a short self-attestation; they usually annualize net earned income to compare against the MFI tables. If you took a lower-paying stop-gap job, bring old and new pay stubs to show whether the new wage is about 50% or less of your prior wage.

Can I use Worker Retraining at an approved provider like Nucamp, and how much would it cost me?

Yes - Worker Retraining funds can be applied at approved private career schools like Nucamp when you meet state eligibility; Nucamp is licensed in Washington and works with colleges to certify applicants. For eligible students, Nucamp often layers its scholarship with state funds so up to about 80% of tuition may be covered, leaving roughly $100/month for five months (≈ $500 total) out of pocket - confirm specifics with the college workforce office and Nucamp before enrolling.

Use this comprehensive Worker Retraining checklist when you sit down with your WIA001 or DD214.

Compare pathways using the step-by-step enrollment roadmap that helps line up funding, benefits, and start dates.

For quick choices, see our list of the top healthcare jobs in Washington that commonly appear on Worker Retraining lists.

Before applying, read the best WRT-approved pre-apprenticeship pathways in Washington to understand admission timelines and funding limits.

If you’re considering bootcamps, read this guide to learn to choose Nucamp with Worker Retraining and compare formats and costs.

Irene Holden

Operations Manager

Former Microsoft Education and Learning Futures Group team member, Irene now oversees instructors at Nucamp while writing about everything tech - from careers to coding bootcamps.