The Complete Guide to Using AI in the Retail Industry in Thailand in 2025

Last Updated: September 14th 2025

Too Long; Didn't Read:

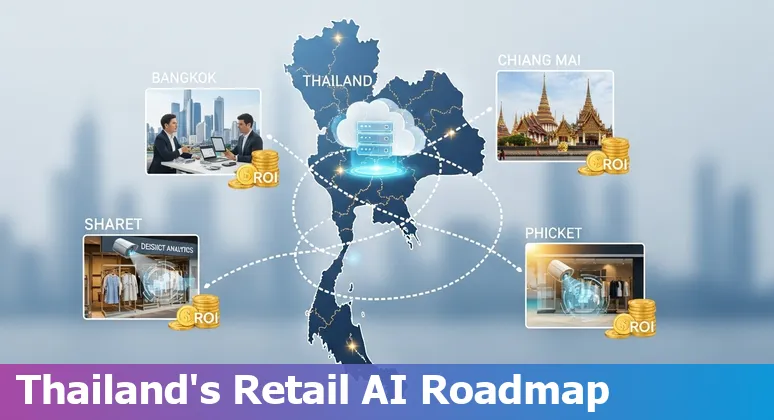

AI in Thailand retail 2025 turns returning tourism (41.1M arrivals; THB 3.0T) and a 2024 market of 4.51T Baht (6.02% growth, 23.5% online) into revenue via personalization, 78% AI adoption, 30–50% inventory cuts and up to 85% forecasting accuracy.

Thailand's retail story in 2025 matters because tourism is back: Intellify projects 41.1 million arrivals and a THB 3.0 trillion tourism market in 2025, and policy moves like visa exemptions and entertainment‑sector reforms are set to lift visitor spending - especially in hubs such as Phuket, Krabi and Bangkok.

AI turns that footfall into measurable advantage through mobile‑first personalization, predictive inventory and Thai‑language conversational assistants that bridge LINE, web and in‑store touchpoints; early results from NTOs show marketing and operations are the fastest routes to ROI (see how how AI is reshaping tourism marketing and operations).

With nearly 18% of Thai companies already using AI and many more planning adoption, practical up‑skilling matters - consider Nucamp's AI Essentials for Work bootcamp to build prompt‑writing and pilot skills that convert policy-driven visitor growth into smarter retail revenue.

| Attribute | Information |

|---|---|

| Description | Gain practical AI skills for any workplace; learn AI tools, prompts, and apply AI across business functions. |

| Length | 15 Weeks |

| Courses included | AI at Work: Foundations; Writing AI Prompts; Job Based Practical AI Skills |

| Cost (early bird) | $3,582 |

| Syllabus | AI Essentials for Work syllabus |

| Registration | Register for AI Essentials for Work |

AI offers new opportunities for Europe's National Tourism Organisations to enhance their operations, particularly in areas like marketing and research. What we are seeing is a wave of experimentation driven by real enthusiasm, but also shaped by uneven capacity across organisations. This is why it is so important to create spaces for shared learning, build practical skills, and support structured innovation. The insights in this study aim to help NTOs confidently navigate this evolving landscape and unlock the value of AI for smarter, more responsive, and more resilient tourism strategies.

Table of Contents

- What is the AI strategy in Thailand? National and industry priorities in 2025

- What is the industry outlook for Thailand in 2025? Retail market context

- How will AI impact industries in Thailand in 2025? Cross‑industry effects

- Does Thailand use AI? Current adoption and real Thai examples

- Core AI use cases in Thai retail in 2025

- Measured business impact & ROI for retailers in Thailand

- Technology, vendors and platform choices for Thailand retail AI

- Implementation roadmap for Thai retailers: practical step-by-step

- Conclusion & next steps for retailers in Thailand in 2025

- Frequently Asked Questions

Experience a new way of learning AI, tools like ChatGPT, and productivity skills at Nucamp's Thailand bootcamp.

What is the AI strategy in Thailand? National and industry priorities in 2025

(Up)Thailand's AI strategy in 2025 is a tightrope walk between ambitious, innovation‑first goals and careful, ethics‑led governance: the Ministry of Digital Economy and Society coordinates a Thailand 4.0‑aligned push for inclusive digital transformation that foregrounds ethical AI, data protection and sector‑specific rules (see the overview of Thailand AI ethics and regulation overview); at the same time the National AI Committee has set bold workforce targets - including a two‑year plan to train 10 million general AI users and develop tens of thousands of AI professionals - to make those plans real for businesses and communities (National AI Committee workforce targets brief).

Policy makers are deliberately balancing a risk‑based regulatory approach (distinguishing prohibited, high‑risk and ordinary systems), PDPA compliance, and practical innovation tools such as AI sandboxes and an AI Innovation Promotion framework so retailers and startups can experiment under supervision;

commentators describe this as a policy “crossroads” between a stricter Regulated AI Law and a facilitative Supported AI Law that would promote sandboxes, data‑sharing and local legal representation for foreign providers (Analysis: Navigating Thailand's AI law development).

The result for retail: clearer guardrails for high‑risk uses, faster routes to pilot conversational Thai assistants and inventory models, and a national emphasis on up‑skilling so the next wave of AI in stores is both measurable and socially responsible - imagine an AI pilot room where teams can safely test models before they touch customers.

What is the industry outlook for Thailand in 2025? Retail market context

(Up)Thailand's retail outlook for 2025 is upbeat but nuanced: after a strong 2024 when the market grew 6.02% to 4.51 trillion Baht and online channels reached 23.5% of sales, growth will be driven by a twin engine of tourists returning and faster e‑commerce penetration, even as brick‑and‑mortar stays busy - retail space occupancy sat around 94–95% in 2024 (so malls aren't empty, they're just changing).

Expect mid‑single‑digit revenue growth for modern trade (Krungsri forecasts roughly 5–6% annually for 2025–27) with supermarkets and convenience formats expanding fastest, while omnichannel and logistics capacity scale to meet rising online demand; the Trade Policy and Strategy Office projects a steady climb to about 5.61 trillion Baht by 2029.

That mix - healthy footfall in key tourist hubs plus rapidly rising digital sales - means AI pilots that link in‑store systems to online carts, or Thai‑language conversational assistants on LINE and web channels, can turn foot traffic into measurable revenue uplift within months (see the industry outlook and examples from Krungsri and coverage of 2024 retail growth).

For retailers, the practical question is not whether to use AI, but how fast to stitch it into an already busy omnichannel engine.

| Metric | Value / Source |

|---|---|

| 2024 retail market value | 4.51 trillion Baht (Nation Thailand) |

| 2024 retail growth | 6.02% (Nation Thailand) |

| Online share of retail | 23.5% in 2024 (Nation Thailand) |

| Modern trade growth outlook (2025–27) | ~5–6% annually (Krungsri Research) |

| Retail space occupancy (2024) | ~94–95% (Krungsri Research) |

| Forecast to 2029 | Market to reach ~5.61 trillion Baht by 2029 (TPSO via Nation) |

How will AI impact industries in Thailand in 2025? Cross‑industry effects

(Up)Across Thailand in 2025, AI is moving from pilot projects to economy-wide scaffolding: expect a surge in AI-optimised data centres that the market research firm projects at about USD 0.42 billion in 2025, underpinning faster inference for everything from in-store recommendation engines to factory robots (Thailand AI-optimised data centre market (Mordor Intelligence)).

Manufacturing and logistics will lean on robotics and smart supply chains as near‑shoring and Industry 4.0 trends push automation into assembly lines and ports, while retail ties omnichannel inventory and Thai‑language conversational assistants into a single customer journey that reduces support load and lifts conversions (see practical retail prompts and assistants for LINE/web chat).

Agriculture and health offer some of the clearest early wins: precision‑farming apps used by hundreds of thousands of farmers and platforms like CyberBrain already show how AI delivers targeted fertiliser and yield advice, and 5G‑enabled AI in hospitals has demonstrated remote diagnostics at scale.

Policy and trust will shape adoption - Thailand's national AI push aims to spread usership and skills even as debates over surveillance, job displacement (millions of roles flagged as high‑risk), and PDPA compliance demand careful governance (Thailand AI policy and sector context (Asia Society)).

The practical “so what?”: retailers and industrial firms that invest in edge compute, PDPA‑aware data pipelines and Thai‑language assistants can convert tourist footfall and rising e‑commerce into measurable revenue within months, not years (Thai-language conversational AI assistants for retail (prompts and use cases)).

| Metric | Value / Source |

|---|---|

| AI‑optimised data centre market (2025) | USD 0.42 billion ( - Mordor Intelligence) |

| National AI targets (aspirational) | 10 million AI users; targets for AI professionals and developers ( - NSTDA / national strategy) |

| Public sentiment in Thailand (2024–25) | 77% view AI products/services as more beneficial than harmful ( - Stanford AI Index) |

Does Thailand use AI? Current adoption and real Thai examples

(Up)Yes - Thailand is already using AI in ways that matter for retail: adoption is widespread and practical, not just experimental. By 2025 about 78% of organisations report using AI in at least one business function and the retail vertical is a fast mover (roughly 75% adoption among retailers), with generative tools already in routine use for content (63% of marketers adopt generative AI for content creation) - trends summarized in this industry roundup of AI marketing statistics.

Local market research shows retail and e‑commerce held the largest share of Thailand's AI market in recent years, while global vendors and local integrators (Google Thailand, Microsoft Thailand, AWS, IBM, Salesforce, BlockchainLabs.ai and others) are active partners for deployments.

Practical Thai examples range from Thai‑language conversational assistants that handle LINE, WhatsApp and web chats to omnichannel “connected‑store” systems that tie online carts to in‑store inventory and lift conversions (see Nucamp AI use-case examples).

That said, rising fraud incidents across Southeast Asia and data‑privacy obligations mean deployments must balance speed with PDPA‑aware governance - the opportunity is clear: stores that pair Thai‑language assistants with measured, secure data practices can convert tourist footfall and online traffic into measurable sales gains within months, not years.

| Metric | Value / Source |

|---|---|

| Organisations using AI | 78% (Primal AI marketing statistics) |

| Retail adoption rate | ~75% of retailers (Primal) |

| Generative AI for content | 63% of marketers (Primal) |

| Public sentiment in Thailand | 77% view AI as more beneficial than harmful (Baytech/AI Index) |

| Thailand AI‑optimised data centre market (2025) | USD 0.42 billion (Mordor Intelligence) |

| Retail & e‑commerce share | Largest vertical share in 2022 (TechSci Research) |

Core AI use cases in Thai retail in 2025

(Up)Core AI use cases in Thai retail in 2025 hinge on a few practical, revenue‑driving plays: supervised‑learning demand forecasting and smart order management that shrink stock waste and stop costly stockouts; Thai‑language conversational assistants that offload support and lift conversions across LINE, WhatsApp and web; and omnichannel “connected‑store” systems that tie online carts to in‑store inventory for seamless fulfilment.

Supervised models turn seasonal sales, browsing signals and social sentiment into precise demand forecasts - BytePlus describes

a retail environment where inventory never runs out

and cites 30–50% reductions in holding costs - while modern order management platforms claim up to 85% forecasting accuracy, cutting forecasting error and speeding ROI. Personalisation and customer‑behaviour prediction feed targeted campaigns that Central Group and e‑commerce leaders have used to improve marketing lift and recommendation accuracy, and PDPA‑aware handovers keep conversations compliant.

For Thai retailers the immediate “so what?” is simple: pair supervised learning with an OMS and a localised conversational assistant and the same tourist surge and omnichannel traffic that stressed legacy systems becomes a measurable revenue stream within months, not years - turning data into fewer empty shelves, faster checkouts and marketing that feels like it was written for one customer at a time (BytePlus supervised learning for Thai retail case study, OrderEazi order management systems improve forecasting accuracy, Thai-language conversational AI assistants for retail in Thailand).

| Use case metric | Value / Source |

|---|---|

| Inventory holding cost reduction (supervised learning) | 30–50% (BytePlus) |

| Forecasting accuracy (order management systems) | Up to 85% (OrderEazi) |

| Central Group reported improvements | 25% reduction in carrying costs; 40% improvement in marketing effectiveness (BytePlus case study) |

| Recommendation/search accuracy (e‑commerce) | ~85% prediction accuracy (Lazada case, BytePlus) |

Measured business impact & ROI for retailers in Thailand

(Up)Measured business impact in Thailand is already concrete: coalition loyalty platforms like Central Group's The 1 - with more than 20 million members, almost a third of the country - turn channel‑spanning data into hyper‑targeted campaigns and AI‑driven predictions that identify high‑value segments and lift relevance at scale (see Central Group's data strategy in Retail Asia).

Loyalty itself is a growing revenue engine - the market is forecast to reach US$672.8 million in 2025 and is expected to keep expanding through 2029 - so investments in personalised rewards and digital wallets rapidly pay back as point redemptions and repeat visits rise (ResearchAndMarkets market briefing).

Measured uplifts from recommendation and post‑purchase programs are striking: cross‑sell/upsell tactics often account for 10–30% of ecommerce sales, and parcelLab case studies show post‑purchase personalization delivering double‑digit revenue lifts (for example, a 19% revenue increase and an 8% basket‑size boost in one client case).

On the service side, AI that converts voice to text and produces real‑time alerts has already shortened response cycles for Central's call centre (12,000 calls/month), turning manual reporting into instant operational insight and faster customer recovery.

| Metric | Value / Source |

|---|---|

| Loyalty market size (2025) | US$672.8M (ResearchAndMarkets / BusinessWire) |

| The 1 app membership | 20+ million members (~1/3 of Thailand) (Retail Asia) |

| Central call centre volume | ~12,000 calls/month; 50,000 minutes (Retail Asia) |

| Post‑purchase revenue lift (case) | 19% revenue increase; 8% basket size increase (parcelLab) |

| Upsell / cross‑sell contribution | 10–30% of ecommerce sales (parcelLab) |

| Forecast CAGR (2025–2029) | ~13.7% loyalty market CAGR (ResearchAndMarkets) |

Technology, vendors and platform choices for Thailand retail AI

(Up)Choosing the right technology stack in Thailand's 2025 retail market is a pragmatic blend of global clouds, regional AI specialists and local partners: major cloud platforms (AWS, Azure, Google Cloud, Salesforce, IBM) remain the backbone for scalability and must be evaluated for PDPA alignment and local data residency, while BytePlus is even exploring a dedicated data centre in Thailand in 2025 to bring lower‑latency cloud and AI services closer to retailers (BytePlus plans Thailand data centre for cloud and AI services).

For edge and in‑store intelligence, vision‑AI vendors are scaling through partners - Tapway's SamurAI (launched 2024) has tied up with three Thai channel partners and aims to install 500 camera licenses in Thailand within the next 12 months, making real‑time loss prevention and queue analytics deployable at mall scale (Tapway SamurAI partners with Thai firms for vision AI deployment).

Expect a layered approach: cloud platforms for model training and compliance, regional vendors and integrators for localised computer‑vision and Thai‑language assistants, and SaaS vendors embedding generative AI into familiar tools so retail teams can adopt features without heavy re‑engineering (see the market roundup of cloud providers and local considerations) (Top cloud solutions for Thai enterprises).

The practical takeaway: pick cloud partners that support PDPA and hybrid deployments, vet regional integrators for on‑the‑ground support, and prioritise pilots that deliver measurable in‑store wins - think a pilot that connects a handful of POS, 10 cameras and a Thai‑language chat assistant and proves uplift before scaling.

| Vendor / Category | Role for Thai retail |

|---|---|

| AWS, Azure, Google Cloud, Salesforce, IBM | Core cloud, compliance tools, multi‑cloud/hybrid support |

| BytePlus | Exploring Thailand data centre (2025) for lower latency cloud & AI services |

| Tapway SamurAI | Vision AI platform with Thai channel partners; target 500 camera licenses in Thailand |

| Local integrators / SaaS | Embed generative AI into retail workflows and handle PDPA/localisation |

“Our collaboration with Tapway delivers AI Vision that is truly accessible - quick to deploy, intuitive to operate, and flexible enough for customers to train additional models on their own.”

Implementation roadmap for Thai retailers: practical step-by-step

(Up)Start with a tightly scoped business question (reduce stockouts, lift LINE conversions, cut call‑centre load) and insist on measurable KPIs before touching tech: revenue uplift, forecasting accuracy, or reduced handling time; this is the “why” that keeps pilots useful rather than shiny.

Next, run a quick readiness check - data quality, PDPA compliance, and whether POS, e‑commerce and loyalty systems can share events - and pick partners who know the Thai market and language nuances (look for local expertise like Amity Thai‑language customer engagement platform that blends product and Thai‑language support).

Design a short, high‑impact pilot (1–3 months) that connects a handful of POS terminals, about 10 cameras for shelf/queue analytics and a Thai‑language LINE/web assistant to prove uplift in weeks rather than years; use proven inventory models and demand forecasting to show immediate ROI (see BytePlus intelligent inventory solutions).

Follow a phased rollout and MLOps plan - build infra and hybrid cloud choices, automate data pipelines, establish CI/CD for models, and set retraining triggers - so models don't degrade once tourists flood back to Phuket or Bangkok.

Invest in people: cross‑functional “AI champions,” frontline training and clear escalation paths so staff trust the system. Measure business and technical KPIs continuously, iterate on failures, and scale only after the pilot meets KPIs and governance checks; a six‑phase methodology (strategy → infra → data → models → deployment/MLOps → governance) gives the structure retailers in Thailand need to move from experiment to sustained value without blowing the budget or sacrificing PDPA compliance (see HP's implementation roadmap for phased AI adoption).

| Phase | Typical duration (HP guide) |

|---|---|

| Phase 1: Strategic alignment & use‑case selection | 2–3 months |

| Phase 2: Infrastructure & architecture | 3–4 months |

| Phase 3: Data pipelines & governance | 4–6 months |

| Phase 4: Model development & integration | 6–9 months |

| Phase 5: Deployment, MLOps & enablement | 3–4 months |

| Phase 6: Governance, ethics & continuous optimisation | Ongoing |

“AI should be approached with purpose – tied directly to defined business goals and evaluated through outcome-driven metrics.” - Adeel Mankee

Conclusion & next steps for retailers in Thailand in 2025

(Up)The path forward for Thai retailers in 2025 is pragmatic: pick one clear business question (reduce stockouts, raise LINE conversions, or cut call‑centre load), prove it with a tight pilot, and scale only after KPIs and PDPA checks pass.

Choose partners who know Thailand's language, culture and operational quirks - look to Amity's local expertise for Thai‑language engagement and partner selection - and design a short, high‑impact pilot (the playbook used across the market often starts with a handful of POS terminals, ~10 cameras for shelf/queue analytics and a LINE/web conversational assistant) so uplift shows up in weeks, not years.

Invest in people as much as tech: practical training builds “AI champions” who can prompt, verify and govern models (consider Nucamp's AI Essentials for Work to build those skills quickly).

Finally, follow a phased implementation route - strategy, infra, data, models, MLOps and governance - using HP's six‑phase roadmap as a checklist to avoid common pitfalls and lock in measurable ROI; starting small, measuring often and choosing PDPA‑aware vendors turns the tourist footfall and rising e‑commerce traffic into reliable sales growth rather than operational noise.

| Attribute | Information |

|---|---|

| Description | Gain practical AI skills for any workplace; learn AI tools, prompt writing, and apply AI across business functions. |

| Length | 15 Weeks |

| Courses included | AI at Work: Foundations; Writing AI Prompts; Job Based Practical AI Skills |

| Cost (early bird) | $3,582 |

| Syllabus | Nucamp AI Essentials for Work syllabus |

| Registration | Register for the Nucamp AI Essentials for Work bootcamp |

“We are entering the era of technological revolution, where the future of every company is being written by AI.” - Chotima Sitthichaiviset, Business Innovation Director, MFEC

Frequently Asked Questions

(Up)What is the retail and tourism outlook for Thailand in 2025?

Thailand's 2025 outlook is positive: Intellify projects ~41.1 million international arrivals and a THB 3.0 trillion tourism market in 2025. The retail market grew to 4.51 trillion Baht in 2024 (6.02% growth) with online channels at ~23.5% of sales and retail space occupancy around 94–95%. Analysts expect mid‑single‑digit growth for modern trade (Krungsri: ~5–6% annually for 2025–27) and a national forecast toward ~5.61 trillion Baht by 2029 (TPSO). The combination of returning tourists and rising e‑commerce makes short, measurable AI pilots highly attractive for retailers.

How is AI being used in Thai retail and what are the core use cases in 2025?

Core AI uses are mobile‑first personalization, supervised‑learning demand forecasting and order management, Thai‑language conversational assistants (LINE, WhatsApp, web, in‑store), and omnichannel “connected‑store” systems that link online carts to in‑store inventory. Typical outcomes cited: inventory holding cost reductions of 30–50% (BytePlus), forecasting accuracy up to ~85% (order management platforms), and recommendation/search accuracies near ~85% in practice. Practical deployments include vision AI for queue and shelf analytics, LINE/web chat assistants to lift conversions, and integrated OMS + forecasting to reduce stockouts and waste.

What policy, governance and data‑privacy considerations should retailers plan for in Thailand?

Thailand's AI approach in 2025 balances innovation with ethics: the Ministry of Digital Economy and Society and the National AI Committee push Thailand 4.0 goals while emphasising PDPA compliance, ethical AI and risk‑based regulation (prohibited, high‑risk, ordinary systems). Policy tools include AI sandboxes and an AI Innovation Promotion framework to enable supervised experimentation. Retailers must build PDPA‑aware data pipelines, choose vendors supporting local data residency and hybrid deployments, and ensure governance for high‑risk uses and customer consent to avoid regulatory or reputational risk.

What measurable ROI can retailers expect and what implementation roadmap is recommended?

Measured ROI examples include loyalty market growth (forecast US$672.8M in 2025), Central Group's The 1 (>20 million members) turning data into targeted campaigns, and case studies showing post‑purchase personalization lifts (e.g., ~19% revenue increase and ~8% basket size increase). Cross‑sell/upsell can account for 10–30% of ecommerce sales. Recommended implementation: start with a tight business question and KPIs, run a readiness check, then a short pilot (1–3 months) connecting a handful of POS terminals, ~10 cameras (shelf/queue analytics), and a Thai‑language LINE/web assistant to prove uplift. HP's six‑phase roadmap durations: Phase 1 strategy (2–3 months), Phase 2 infra (3–4 months), Phase 3 data & governance (4–6 months), Phase 4 model dev/integration (6–9 months), Phase 5 deployment/MLOps (3–4 months), Phase 6 governance & optimisation (ongoing).

What vendors, technology choices and upskilling options are recommended for Thai retailers?

Recommended stack is layered: global cloud providers (AWS, Azure, Google Cloud, Salesforce, IBM) for scale and compliance; regional platforms and specialists (BytePlus exploring a Thailand data centre in 2025) for lower latency and localisation; and local integrators/SaaS for Thai‑language assistants and edge/vision deployments (example: Tapway SamurAI targeting ~500 camera licences in Thailand). Adoption context: ~78% of organisations use AI and ~75% of retailers report AI use; ~63% of marketers use generative AI for content. Upskilling matters - short practical courses that teach prompt writing, pilot design and operational AI skills accelerate value capture. Nucamp's offering cited in the article: a 15‑week program (AI at Work: Foundations; Writing AI Prompts; Job‑Based Practical AI Skills) with an early‑bird cost of $3,582 to build prompt and pilot skills that convert visitor growth into revenue.

See how real‑time replenishment reduces carrying costs and prevents out‑of‑stocks across Thai stores.

Prevent out-of-stocks and shrinkage using Shelf monitoring with computer vision that balances edge inference and privacy masking for store operations.

Discover practical steps to Pivot into POS maintenance and payments so you can turn automation into a new career path.

Ludo Fourrage

Founder and CEO

Ludovic (Ludo) Fourrage is an education industry veteran, named in 2017 as a Learning Technology Leader by Training Magazine. Before founding Nucamp, Ludo spent 18 years at Microsoft where he led innovation in the learning space. As the Senior Director of Digital Learning at this same company, Ludo led the development of the first of its kind 'YouTube for the Enterprise'. More recently, he delivered one of the most successful Corporate MOOC programs in partnership with top business schools and consulting organizations, i.e. INSEAD, Wharton, London Business School, and Accenture, to name a few. With the belief that the right education for everyone is an achievable goal, Ludo leads the nucamp team in the quest to make quality education accessible