How AI Is Helping Real Estate Companies in Switzerland Cut Costs and Improve Efficiency

Last Updated: September 6th 2025

Too Long; Didn't Read:

AI is helping Swiss real estate cut costs and boost efficiency: 48% of firms use AI in early processes but only ~8% have fully consistent data; AVMs speed valuations, chatbots deliver ~30% faster responses, and document AI extracts 6,000 energy bills/year. (15 weeks, $3,582)

Swiss real estate is crossing an AI tipping point: properti's 2025 analysis shows AI is already speeding valuations, enabling virtual 360° viewings and automating marketing so brokers can focus on high-value advice, while the Swiss AI Report 2025 finds 48% of Swiss firms using AI in early processes - but warns data quality and integration are major bottlenecks (only about 8% have fully consistent data).

That combination - fast, targeted pilots for pricing, marketing and predictive maintenance plus investment in clean data and skills - will determine who gains an edge in Zurich, Geneva and beyond; teams that learn practical prompts and tool workflows can convert pilots into measurable savings.

For Swiss real estate professionals wanting hands-on skills, Nucamp AI Essentials for Work bootcamp (15-week program) teaches usable AI tools and prompt-writing to apply AI across valuations, marketing and operations responsibly.

| Attribute | Information |

|---|---|

| Program | AI Essentials for Work |

| Length | 15 Weeks |

| Cost (early bird) | $3,582 |

| Courses included | AI at Work: Foundations; Writing AI Prompts; Job Based Practical AI Skills |

| Syllabus | View the AI Essentials for Work syllabus (15-week program) |

| Register | Register for the AI Essentials for Work bootcamp |

“Amid evolving market conditions, the Swiss real estate sector is poised for renewed activity, particularly as lower interest rates enhance the appeal of property investments.” - Sebastian Zollinger, PwC Switzerland

Table of Contents

- Faster valuations and transactions in Switzerland

- Marketing, customer experience and lead conversion in Switzerland

- Operational efficiency: documents, contracts and facilities in Switzerland

- Investment, asset management and decision support in Switzerland

- Service model shifts and workforce impacts in Switzerland

- Regulatory, compliance and governance considerations in Switzerland

- Limitations, risks and where human expertise still matters in Switzerland

- Practical implementation path and quick wins for Swiss real estate companies

- Conclusion and next steps for Swiss real estate teams

- Frequently Asked Questions

Understand the essentials of AI governance and FADP compliance in Switzerland to manage legal and ethical risks when deploying models.

Faster valuations and transactions in Switzerland

(Up)In Switzerland, faster valuations and smoother transactions are already practical gains from Automated Valuation Models (AVMs): these mathematical engines can produce consistent, objective desktop estimates in seconds or minutes, scaling to thousands of routine residential checks and speeding mortgage pre‑approvals, portfolio mark‑to‑market reviews and pricing decisions - effectively turning what once took days of desk work into a browser click that returns a value range and a confidence band.

AVMs work best when targeted at standardised, low‑complexity properties and plugged into a hybrid workflow where local expertise checks outliers; RICS guidance and examples from industry providers show that explainability, testing and confidence scores are central to trustworthy use.

Swiss brokers, lenders and asset managers can draw on practical AVM approaches - from explanatory, standards‑led models to audited desktop solutions - to cut turnaround times while preserving regulatory and valuation rigour.

See how industry writeups describe the mechanics and applications of these models in practice with Automated Valuation Models (AVMs) and PriceHubble's AVM research.

“Automation should never compromise professional rigour. As valuers, we have a responsibility to uphold trust, consistency, and compliance. At ValuStrat, our approach to AVMs is rooted in international best practice - not speed for speed's sake, but governance-led innovation that enhances internal quality, never replacing professional judgement.” - Declan King MRICS, Senior Partner ; Group Head of Real Estate, ValuStrat

Marketing, customer experience and lead conversion in Switzerland

(Up)Swiss brokers and proptech teams are already boosting marketing, customer experience and lead conversion with conversational AI that captures visitors, qualifies interest and books viewings around the clock - tools that research shows deliver real uplifts in response speed and conversions.

24/7 chatbots and voice agents handle FAQs, schedule appointments and nurture prospects so human agents focus on high‑value interactions; platforms like Emitrr AI property chatbot for real estate highlight cross‑channel outreach, appointment scheduling and CRM integrations that stop leads from slipping away, while studies of conversational AI (for example, Convin's writeups) report faster responses and material conversion gains for firms that automate first contact and lead scoring (Convin AI in real estate analysis on conversational AI).

For Switzerland the upside is practical: multilingual bots and tailored workflows can respect canton rules and serve German, French and Italian speakers, and simple pilots - such as a bilingual tenant maintenance assistant case study - can cut support costs and improve retention.

The takeaway: targeted chatbot pilots that integrate with local MLS/CRM data, prioritize lead qualification and hand off hot prospects to people are quick wins for Swiss teams aiming to lift conversion without bloating headcount.

Operational efficiency: documents, contracts and facilities in Switzerland

(Up)Operational efficiency in Swiss real estate is now driven by intelligent document workflows that turn paperwork into a competitive advantage: AI orchestration platforms can automate identity checks, KYC, lease creation and approval routing so deals close faster and teams spend less time chasing signatures, while local IDP and OCR vendors handle multilingual documents, redaction and archivable PDF/A storage to meet Swiss audit needs.

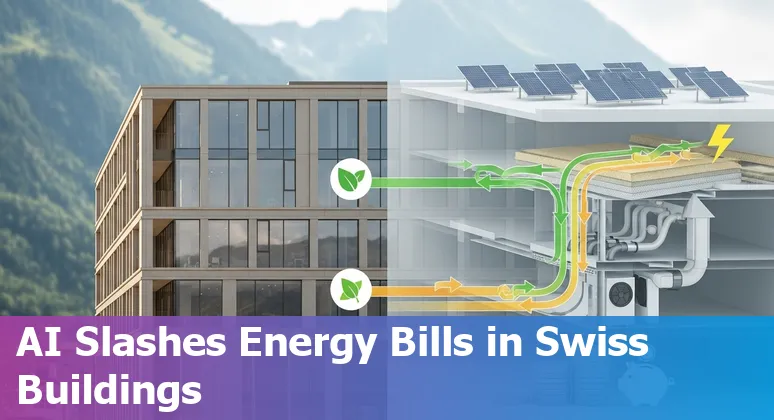

Platforms such as Aurachain AI-powered orchestration platform for real estate promise end-to-end lease and onboarding automation, Swiss OCR specialists like 360core Swiss intelligent document processing and OCR add high-confidence text recognition, language detection and personal-data masking for FADP compliance, and document-extraction providers like Acodis document extraction for real estate show the payoff in practice (Allianz Suisse extracts data from over 6'000 energy bills a year across 300 properties).

The clear “so what?”: fewer manual handoffs, auditable trails and faster maintenance, billing and due diligence mean lower cycle times and measurable cost savings for portfolio managers, brokers and facility teams across Switzerland.

| Provider | Core capability (Swiss focus) |

|---|---|

| Aurachain | Lease & property document automation, identity checks, AI workflow orchestration |

| 360core | High-accuracy OCR, language detection (100+), personal-data masking, PDF/A archiving |

| Acodis | Bulk document extraction (energy bills case: 6'000 bills/year for 300 properties) |

“The response time to enquiries is enormously shortened by these innovations and we can provide our information to our customers much faster and more precisely.” - Shara Geuss, Property Management Team Leader, Welcome Immobilien AG, Switzerland

Investment, asset management and decision support in Switzerland

(Up)For Swiss investors and asset managers, AI is becoming a decision‑support co‑pilot that turns messy signals into timely portfolio actions: macro frameworks such as the one Wellington's Macro Strategist John Butler outlines help teams translate AI-driven scenario analysis into questions about interest rates, credit and market positioning, while model governance matters on the ground - adopting FINMA-style model risk management is a practical way for mortgage and lending teams to align automated valuations and stress tests with Swiss regulatory expectations (Wellington insights: Macro Implications of the AI Revolution report, FINMA model risk management guidance for Swiss financial institutions).

The “so what?” is sharp: better signals mean faster re‑pricing, clearer cap‑ex prioritisation and earlier identification of underperforming assets - imagine a dashboard flagging a mispriced block before quarter‑end - so teams can act decisively rather than reactively.

Service model shifts and workforce impacts in Switzerland

(Up)Swiss real estate service models are already tilting from transaction-heavy teams to “bionic” advisers and oversight roles as AI takes on routine work: PwC Switzerland GenAI research on private-wealth advisors shows early pilots freeing advisors from admin so they can spend more time on client relationships, while WealthTech Today reporting on intelligent agents rewiring wealthtech workflows documents how notetakers are evolving into intelligent agents that auto‑update CRMs, trigger compliance checks and launch back‑office workflows - replacing copy‑paste chores with exception handling and judgment calls.

On the operations side, multilingual tenant chatbots and maintenance assistants show how firms can cut support costs and improve retention by automating routine requests and handoffs - freeing property managers to focus on exceptions and tenant experience (Bilingual tenant maintenance assistant AI case study for Swiss real estate).

The practical outcome for Swiss teams: fewer entry‑level data roles, more hybrid jobs that pair technical oversight with client empathy, and a clear need for upskilling in model governance, multilingual orchestration and human‑in‑the‑loop controls to keep services trusted and compliant.

| Service model shift | Workforce impact (Switzerland) |

|---|---|

| Admin automation (GenAI) | Advisors freed for relationship work; fewer pure data‑entry roles |

| AI notetakers → intelligent agents | Roles move to oversight, exception handling and governance |

| Multilingual tenant bots & assistants | Lower support costs; focus on retention and complex case handling |

Regulatory, compliance and governance considerations in Switzerland

(Up)Regulatory, compliance and governance considerations in Switzerland are practical must‑haves, not future theory: the Federal Council chose a sector‑specific, risk‑based route on 12 February 2025 that prioritises ratifying the Council of Europe's AI Convention and drafting targeted measures rather than a sweeping horizontal law, with a draft bill and non‑legislative plan expected by the end of 2026 (so Swiss teams have a clear runway to prepare) - see the analysis from Lenz & Staehelin on the Federal Council's approach and practical next steps.

In the meantime Swiss law already bites: the revised Federal Data Protection Act (FADP) (effective 1 Sep 2023) requires disclosure and review rights for automated individual decisions (Art.21), FINMA expects robust model governance in supervised firms, and courts and IP practice confirm that inventorship and other rights still hinge on human contribution.

The upshot for real‑estate operators and proptechs is concrete: keep an AI inventory, classify risk, document data sources and human oversight, embed human‑in‑the‑loop checks for tenant‑facing automation, and ensure boards can evidence at least one technically literate director and robust model‑risk controls - advice aligned with practical guidance in Pestalozzi's regulatory briefing.

Also watch the EU AI Act's extraterritorial reach: firms operating with EU ties must map obligations now to avoid late, costly rework.

| Milestone | Date / Deadline | Source |

|---|---|---|

| Revised FADP (automated decisions, Art.21) | 1 Sep 2023 | Pestalozzi (Navigating AI) |

| Federal Council AI regulatory approach adopted | 12 Feb 2025 | Lenz & Staehelin |

| AI Convention signed by Switzerland | Mar 27, 2025 | GlobalPractice Guides |

| Draft bill & non‑legislative plan due | End of 2026 | Federal Council reports (Pestalozzi / GLI) |

Limitations, risks and where human expertise still matters in Switzerland

(Up)Swiss teams should welcome AVMs for speed but keep a clear line where human expertise still matters: models can offer consistent, scalable desktop estimates, yet their accuracy is only as good as the input - outdated public records, missing renovations, or unique houses that lack comparables can skew results, and

a newly renovated kitchen or a damaged roof won't be reflected in the valuation

without a human check.

Research that probes AVM bias shows the technology can reduce subjective errors but also inherit historical distortions unless rigorously tested and explainable (Veros webcast on AVM bias), while practical reviews stress data‑quality, confidence scores and random‑sample testing as basic safeguards (Certified Credit deep dive on AVM limitations and regulatory measures).

so what?

The pragmatic answer for Switzerland: adopt a hybrid workflow - use AVMs for routine scopes, mandate human‑in‑the‑loop review for outliers and complex assets, and embed robust model‑risk practices such as FINMA‑style governance to catch blind spots before they become costly mistakes.

Practical implementation path and quick wins for Swiss real estate companies

(Up)Swiss real estate teams can move from curiosity to impact by following a pragmatic, staged playbook: set a clear objective (e.g., halve lead‑response time or speed initial site screens), run a small “2×2” pilot slate with two quick‑win automations and two aspirational use cases, and measure against baseline KPIs; GrowthFactor's implementation roadmap shows how feasibility work that once took 3–4 weeks can be cut to about 10 minutes with the right models, so start where time savings are obvious and repeatable (GrowthFactor blog - AI Properties and Real Estate).

Quick wins for Switzerland usually mean multilingual conversational agents to capture and qualify web and WhatsApp leads 24/7 (Convin reports ~30% faster responses and meaningful conversion uplifts), automated desktop AVMs for routine valuations with human‑in‑the‑loop checks, and pilot site‑selection or lease‑abstraction proofs that prove ROI fast (Convin blog - AI in Real Estate).

Keep pilots small, ensure data is inventoried and cleaned, instrument outcomes (response time, conversion, underwriting hours saved), and scale what moves the needle - Swiss teams that start with focused, measurable pilots and multilingual customer journeys will capture savings quickly and reduce costly manual churn (SwissCognitive - Real Estate Industry & AI).

Conclusion and next steps for Swiss real estate teams

(Up)Swiss real estate teams should finish the digital sprint by turning today's pilots into repeatable routines: start small (a multilingual lead‑capturing bot plus an AVM screening for standard urban homes), require human‑in‑the‑loop checks for atypical or high‑stake files, and instrument outcomes so savings and risk reductions are measurable; providers like SwissAI make it practical to enrich pricing and site selection with footfall and demographic signals via their HUMAQ platform (SwissAI real estate solutions), while valuations research and market practice in Switzerland show AVMs deliver fast, reliable desktop estimates for standard properties but must be paired with expert appraisal for complex assets (see coverage of AVM adoption at SIPA analysis of AI in Swiss property valuation).

Learn the skills that make pilots stick - prompt design, tool workflows and governance - by upskilling teams (consider the practical 15‑week option at Nucamp AI Essentials for Work bootcamp (15-week)) so technology empowers advisers rather than replacing them; the immediate payoff is faster turnarounds, fewer manual handoffs and clearer, audit‑ready decision trails.

| Attribute | Information |

|---|---|

| Program | AI Essentials for Work |

| Description | Gain practical AI skills for any workplace; learn AI tools, prompt writing, and apply AI across business functions (no technical background required) |

| Length | 15 Weeks |

| Courses included | AI at Work: Foundations; Writing AI Prompts; Job Based Practical AI Skills |

| Cost (early bird) | $3,582 |

| Register / Syllabus | AI Essentials for Work syllabus · AI Essentials for Work registration |

Frequently Asked Questions

(Up)How is AI cutting costs and improving efficiency for real estate companies in Switzerland?

AI reduces costs and boosts efficiency through several practical levers: Automated Valuation Models (AVMs) that deliver consistent desktop valuations in seconds or minutes (replacing days of desk work for routine checks); multilingual conversational bots that capture, qualify and schedule leads 24/7 (research shows meaningful uplifts in response speed and conversion, e.g., ~30% faster responses in some studies); intelligent document workflows (OCR/IDP, lease generation, KYC and redaction) that cut manual handoffs and create auditable trails (example: Allianz Suisse extracts data from ~6,000 energy bills/year across 300 properties); and decision‑support tools that speed repricing and cap‑ex prioritisation. The practical approach is small, measurable pilots (multilingual bot + AVM screening), human‑in‑the‑loop for exceptions, and instrumenting KPIs to convert pilots into measurable savings.

What are AVMs, where do they work best, and what limitations should Swiss firms expect?

Automated Valuation Models (AVMs) are mathematical engines that produce desktop price estimates and confidence bands quickly. They work best for standardised, low‑complexity residential assets and high‑volume routine checks (mortgage pre‑approvals, portfolio mark‑to‑market). Limitations include reliance on input data (missing renovations, unique properties or outdated public records can skew results), potential inherited historical bias, and cases where explainability and testing are required by guidance such as RICS. Best practice: use AVMs for routine scopes, require human‑in‑the‑loop review for outliers and complex assets, report confidence scores, and apply FINMA‑style model governance and random‑sample testing to manage risk.

How widespread is AI use in Swiss firms and what are the main data/integration bottlenecks?

The Swiss AI Report 2025 shows adoption is growing - about 48% of Swiss firms are using AI in early processes - but data quality and integration are major bottlenecks: only roughly 8% of firms have fully consistent data across systems. That gap makes pilots fragile unless firms invest in data inventories, cleaning, connectors to MLS/CRM, and consistent schemas. Practical steps include creating an AI inventory, prioritising data work for pilot use cases, and focusing on small repeatable automations that rely on high‑confidence data.

What regulatory and compliance actions must Swiss real estate and proptech teams take when deploying AI?

Swiss teams must treat AI governance as a compliance imperative. Key milestones: the revised Federal Data Protection Act (FADP) requiring disclosure and review rights for automated individual decisions (Art.21) came into effect 1 Sep 2023; the Federal Council adopted a sector‑specific, risk‑based AI approach on 12 Feb 2025 and Switzerland signed the Council of Europe AI Convention on 27 Mar 2025, with a draft bill and non‑legislative plan expected by end of 2026. Practical obligations: keep an AI inventory, classify use‑case risk, document data sources and human oversight, embed human‑in‑the‑loop for tenant‑facing automation, ensure model‑risk governance in line with FINMA expectations, and have technically literate board oversight to evidence governance.

How can Swiss real estate teams get started quickly and what training or programs help convert pilots into repeatable savings?

Start with a focused, staged playbook: set a clear objective (e.g., halve lead‑response time), run a 2×2 pilot slate (two quick wins, two aspirational cases), measure baseline KPIs (response time, conversion, underwriting hours saved), and scale what moves the needle. Typical quick wins: multilingual lead‑capturing bots integrated with CRM/MLS, desktop AVMs for standard urban homes with human checks, and lease abstraction/document automation. Upskilling is essential - programs such as 'AI Essentials for Work' (15 weeks, early bird cost $3,582) teach practical AI tools, prompt writing and tool workflows so teams can design reliable pilots, manage vendor integrations (e.g., Aurachain, 360core, Acodis, SwissAI) and embed governance to make savings repeatable.

With data-driven pricing on the rise, the threat from Automated valuation models (AVMs) is pushing junior valuers to specialise in complex, local expertise.

Imagine a WhatsApp conversational search and scheduling assistant that understands Swiss dialects and books showings across cantons.

Ludo Fourrage

Founder and CEO

Ludovic (Ludo) Fourrage is an education industry veteran, named in 2017 as a Learning Technology Leader by Training Magazine. Before founding Nucamp, Ludo spent 18 years at Microsoft where he led innovation in the learning space. As the Senior Director of Digital Learning at this same company, Ludo led the development of the first of its kind 'YouTube for the Enterprise'. More recently, he delivered one of the most successful Corporate MOOC programs in partnership with top business schools and consulting organizations, i.e. INSEAD, Wharton, London Business School, and Accenture, to name a few. With the belief that the right education for everyone is an achievable goal, Ludo leads the nucamp team in the quest to make quality education accessible